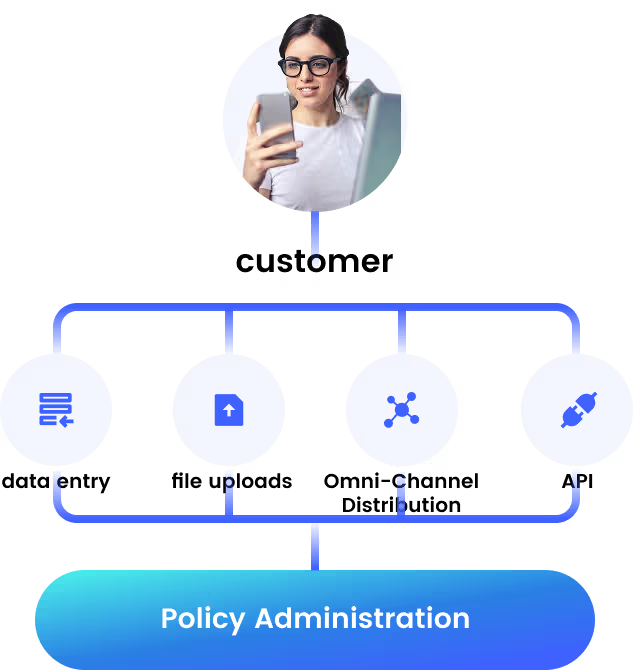

Policy intake - via all channels

Streamline insurance quotation and submissions through data entry, file uploads, the Omni-Channel Distribution Platform, or API integrations.

With OCR and intelligent data extraction and mapping, the submission process is made faster, easier, and more accurate.

Robust risk management framework

A powerful risk management framework combines rules-driven classification, in-house data analysis, third-party expert engines, compliance screening, and AI assistant, enabling automated, intelligent, and accurate decisions.

Fully digitalized underwriting

Most risks are underwritten via STP, while referral process is fully digitalized with 360 data insights & prompts, and online engagement with customers, channels, and partners.

Streamlined policy services and renewal

Policy endorsement, services, and renewal are highly automated, seamlessly integrated with Claims Administration and analytics, and offered as self-service to customers, channels besides the insurer's processing team.

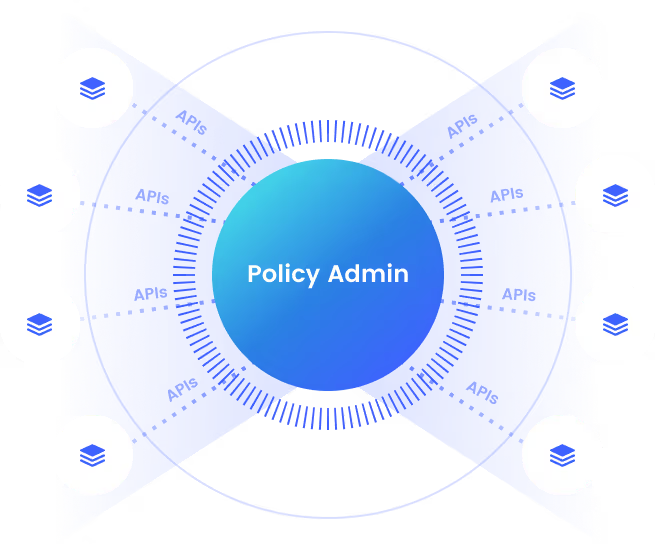

Policy APIs ready

A comprehensive library of out-of-the-box policy APIs enables seamless external integration - covering rating, quotation, binding, issuance, endorsement, underwriting, renewal, compliance, reinsurance and more - ensuring fast, smooth communication between Policy Admin and the ecosystem.

Add-ons

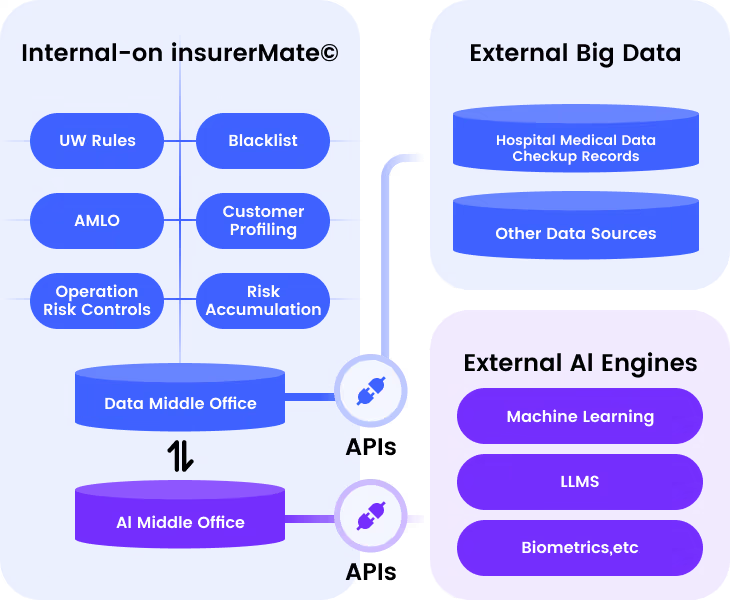

AI Middle Office

Unleash the full power of your stack: seamlessly orchestrate native AI with every API to build end-to-end intelligent automation.

Partner Solutions

Explore plug-in solutions from our partners.