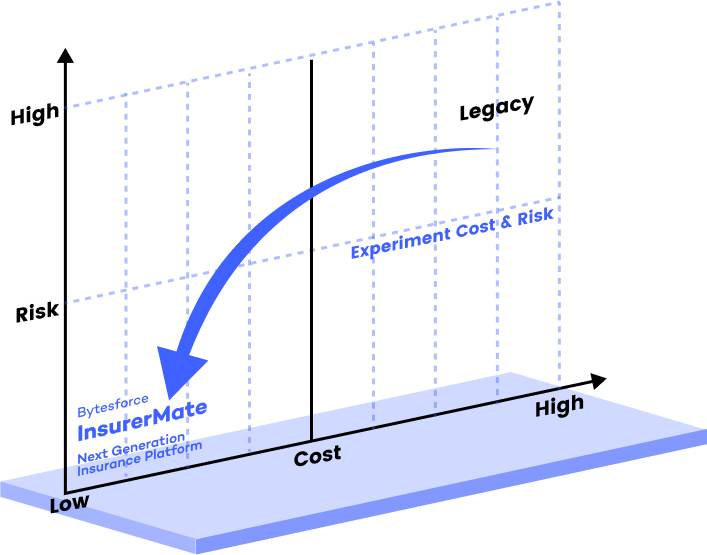

Dual core strategy

Adopting a dual-core strategy, EMiC allows insurers to embrace digital retail rapidly, cost-effectively, and without disrupting existing business operations. This approach enables a smooth transition into the online marketplace, accelerates product innovation, and expands distribution capabilities, all while safeguarding the stability of core legacy systems.

Why Embedded Micro-insurance Core

Accelerate Product Innovation

Launch innovative products fast with our flexible product engine - event-driven, usage-based, telematics, life/non-life bundles, and insurance/non-insurance combos.

Embed in all ways

Whether via APIs, embedded journeys, referral links, or bulk file processing, insurance can now be embedded anywhere, in any form.

Full automation end-to-end

Reduce operational costs to near zero with built-in powerful engines and APIs across the insurance lifecycle, delivering unprecedented real-time experiences for online customers.

Adaptive boundaryless design

Unlike traditional core platforms, a wide variety of products, processes, and embedding scenarios are fully segregated to prevent cross-impact, ensuring a stable and consistent experience.

Reliable, secure & high-performance

Available 24/7 with zero downtime, secured by high-standard protection measures. Delivers fast response times and scales vertically and horizontally.

Trusted By

Impact at a glance

Experiment at near-zero cost

Our client, a leading internet insurer in SEA, achieved remarkable results by embedding 50+ micro-insurance products. Discover how our Embedded Micro-insurance Core powered high volumes and diverse scenarios for their business.

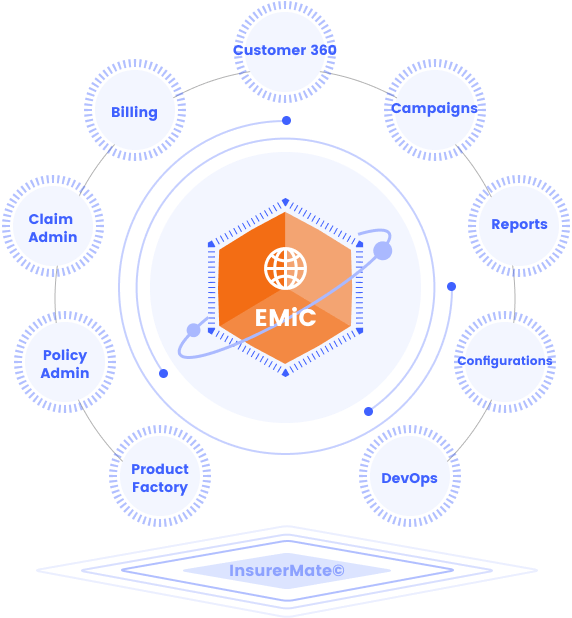

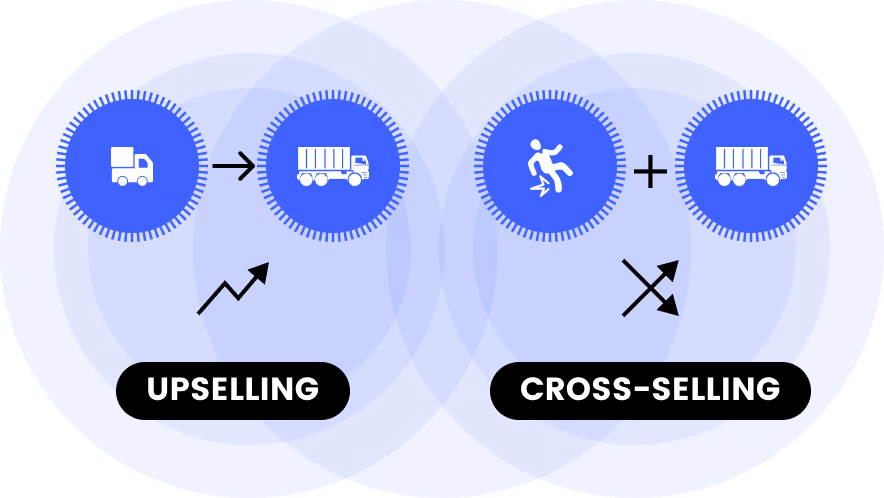

Cross-sell and up-sell

With customer-centric design, channel ochestration capability, and the unified InsurerMate© platform, micro-insurance covers can be upgraded seamlessly - cutting acquisition costs and boosting conversion rates.

Add-ons

AI Middle Office

Unleash the full power of your stack: seamlessly orchestrate native AI with every API to build end-to-end intelligent automation.

Partner Solutions

Explore plug-in solutions from our partners.

Discover More

Official launch of SCOR International / RSG new core platform

[Kuala Lumpur & Beijing] Remark Solutions Group (RSG) has successfully launched its new digital insurance core platform in Malaysia and China, marking a significant milestone in its digital transformation journey.

EFGH has partnered Bytesforce to promote embedded insurance in Africa and globally

[Singapore] Embed Financial Group Holding (EFGH, https://efgh.xyz/) has announced a strategic partnership with Bytesforce to advance the adoption of embedded micro insurance solutions across Africa and international markets.